Did you know the influencer marketing industry in India is projected to grow at a Compound Annual Growth Rate (CAGR) of 25% until 2026. By 2027, the market is expected to reach an estimated value of over ₹107 billion.

In this industry, one of the highly sought after arenas is finance influencers. Are you struggling to make sense of where your money goes each month or wondering how to start investing without feeling overwhelmed? You’re not alone.

In a world where financial literacy is still a privilege for many, everyday money management often feels confusing, stressful, or out of reach. But that’s changing fast. The top financial influencers in India are bringing money wisdom straight to your feed, one reel at a time.

Whether it’s investment hacks, stock market updates, or tips to stretch your salary till the month’s end, these content creators are turning complex financial topics into everyday conversations.

Ready to take control of your finances? Here are the top finance influencers in India you should be following right now.

Top 10 Finance Influencers in India

Finance influencers in India grew to over 232,000 by 2024, with a 91% increase between 2020 and 2022. Having said that, here’s a curated list of some of the most influential finance content creators in India:

1. Rachana Phadke Ranade

| Platforms | Followers |

| 1.1 million | |

| YouTube | 5.23 million |

| 780K | |

| X (Formerly Twitter) | 200.4K |

Rachana Phadke Ranade is a Chartered Accountant (CA) and educator known for simplifying stock market and finance concepts. She creates beginner-friendly content in both English and Marathi. Founder of a popular online finance academy, she has taught over 100,000 students. Rachana’s clear teaching style and passion for financial literacy have made her one of India’s most trusted voices in personal finance education.

2. Sharan Hegde

| Platforms | Followers |

| 2.7 million | |

| YouTube | 3.5 million |

| 472K | |

| X (Formerly Twitter) | 69.7K |

Sharan Hegde is known for simplifying personal finance through storytelling and humor. A former consultant and Columbia MBA student, he founded The 1% Club, India’s largest finance community. Featured in Forbes 30 Under 30, he’s making finance accessible and engaging for India’s Gen Z and millennials. He creates content on investing, saving, and money habits.

3. Ankur Warikoo

| Platforms | Followers |

| 3.7 million | |

| YouTube | 6.18 million |

| 247K | |

| X (Formerly Twitter) | 626.2K |

Ankur Warikoo is an Indian entrepreneur, bestselling author, and one of the country’s most influential content creators. He co-founded the e-commerce platform Nearbuy and previously served as the CEO of Groupon India. Warikoo shares valuable insights on entrepreneurship, personal finance, and career development through his content. His books, Do Epic Shit and Get Epic Shit Done, have received widespread acclaim. Recognized by Forbes and LinkedIn for his impact, he also actively invests as an angel and mentors aspiring entrepreneurs.

4. Neha Nagar

| Platforms | Followers |

| 1.8 million | |

| YouTube | 387K |

| 119K | |

| X (Formerly Twitter) | 107.6K |

Neha Nagar, founder of Filmy Finance, is dedicated to making financial literacy accessible and engaging. She uses her background as a former wealth manager at India Infoline Finance Limited (IIFL) to break complex financial topics through relatable content. Her innovative approach earned her the Finance Influencer of the Year award in 2023 and a feature on the Forbes cover in 2022.

5. Pranjal Kamra

| Platforms | Followers |

| 935K | |

| YouTube | 6.4 million |

| 246K | |

| X (Formerly Twitter) | 158.8K |

Pranjal Kamra is a renowned Indian fintech entrepreneur and content creator, best known for founding Finology Ventures and his popular YouTube channel. He simplifies personal finance and stock market concepts for a broad audience. A law graduate and National Institutes of Securities Market (NISM) alum, Kamra’s impact in financial education earned him a spot in Forbes India’s Digital Stars 2023 list and numerous accolades as a leading finfluencer.

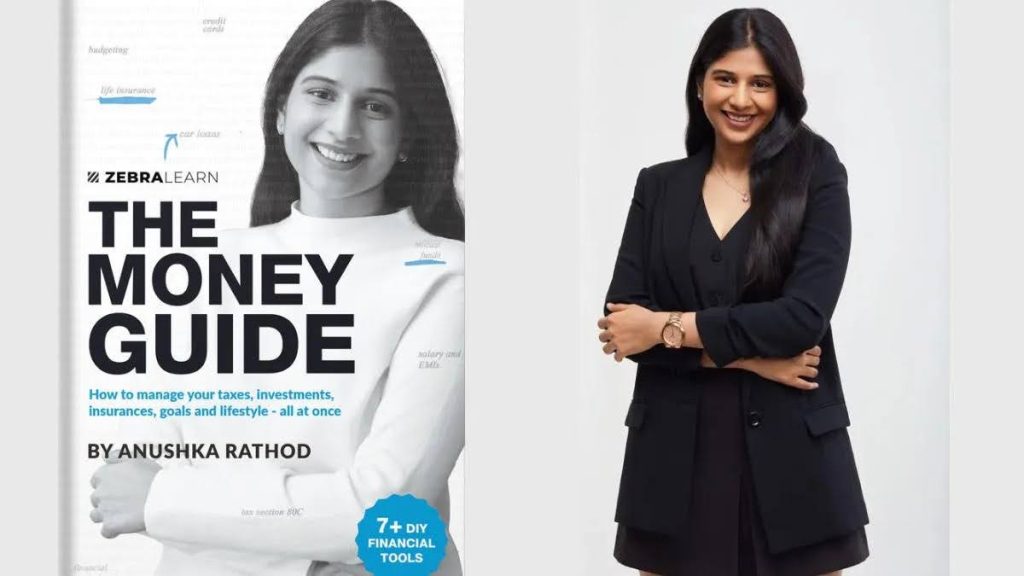

6. Anushka Rathod

| Platforms | Followers |

| 1.1 million | |

| YouTube | 711K |

| 88K | |

| X (Formerly Twitter) | 19.9K |

Anushka Rathod is celebrated for making financial literacy accessible and engaging. She simplifies complex financial concepts, empowering her audience to make informed decisions. In 2024, she was honored with a spot on both Forbes India and Forbes Asia’s 30 Under 30 lists, recognizing her significant impact in the digital content space. Anushka’s debut book, The Money Guide, offers practical insights into managing finances, budgeting, and investing.

7. Abhishek Kar

| Platforms | Followers |

| 2.9 million | |

| YouTube | 1.94 million |

| 24K | |

| X (Formerly Twitter) | 385.9K |

Abhishek Kar is a prominent Indian financial educator and YouTuber, known for his channel Abhishek Kar. With expertise in stock markets, investments, and entrepreneurship, he simplifies complex financial topics for a broad audience. Abhishek is also a bestselling author, TEDx speaker, and has been featured in major outlets like Moneycontrol and The Economic Times, making finance accessible to millions.

8. CA Sarthak Ahuja

| Platforms | Followers |

| 2.1 million | |

| YouTube | 123K |

| 240K | |

| X (Formerly Twitter) | 2,036 |

CA Sarthak Ahuja is a finance educator, entrepreneur, and one of the youngest Indians to complete CA, Computer Science (CS), Certified Management Accountant (CMA), and Bachelor of Finance and Investment Analysis (BFIA) by age 23. A gold medalist from Indian School of Business (ISB), he is the author of bestsellers like Daily Coffee & Startup Fundraising. He mentors startups as a Virtual CFO, teaches at top institutes, and runs popular finance and business courses, making complex topics accessible to all.

9. Anant Ladha

| Platforms | Followers |

| 1 million | |

| YouTube | 14.2K |

| 31K | |

| X (Formerly Twitter) | 90.4K |

Anant Ladha is a finance educator and founder of Invest Aaj For Kal, a platform promoting financial literacy in India. A Chartered Financial Analyst (CFA), CA, Certified Financial Planner (CFP), and lawyer, he began investing at 14. Recognized with 20 national awards, Anant has delivered TEDx talks and educated millions through his content, aiming to turn India into a nation of informed investors.

10. Nitin Joshi

| Platforms | Followers |

| 1.5 million | |

| YouTube | 167K |

| 31K | |

| X (Formerly Twitter) | 138 |

Nitin Joshi is a dynamic Indian finance influencer, entrepreneur, and content creator dedicated to making financial literacy accessible to all. He simplifies complex financial concepts through engaging content. Nitin is also a TEDx speaker, sharing insights on entrepreneurship and financial independence. His mission is to empower individuals to make informed financial decisions and achieve financial freedom.

With so many voices offering financial advice online, it’s important to differentiate the credible ones from the rest. In the next section, let’s find out what sets a finance influencer apart from the rest of them.

Also Read: Leveraging Authenticity for Brand Growth: The Rise of Micro-Influencers

What Sets a Finance Influencer Apart?

Not everyone who talks about money online is worth listening to and when it comes to your finances, credibility matters. To follow the right voices, here’s what you should look for when selecting India’s top finance influencers:

- Proven Financial Expertise: A standout finance influencer brings more than just opinions, they bring experience. Whether they’re a certified chartered accountant, a seasoned investor, or a market expert, their insights are grounded in real-world knowledge and data-backed advice.

- Skill in Simplifying Complex Concepts: Financial topics can be intimidating, but great influencers break them down with ease. From explaining tax laws to demystifying the stock market, the best creators make complex subjects understandable through reels, visuals, and straight-talking videos.

- Honest, Unbiased Recommendations: Authenticity is everything. Top influencers prioritize trust, offering genuine advice not just paid promotions. Look for creators who share honest reviews and don’t compromise on integrity, even if it means turning down brand deals.

- Engaging and Educational Content: Let’s face it, if the content doesn’t hook you, you’ll scroll past it. The best influencers combine valuable information with creativity. Some use humor, others lean on storytelling or relatable examples, but all know how to keep financial learning fun and impactful.

Want to build your own brand as a trusted finance educator? Exly provides a complete toolkit, from custom-branded websites to secure payment systems, to help you grow your audience and monetize your knowledge with ease.

Impact of Finance Influencers on Financial Literacy and Inclusion

Finance influencers in India have significantly reshaped how people access and understand financial information. Once limited to textbooks, seminars, or professional advisors, financial education has now become more inclusive, relatable, and accessible, thanks to creators who simplify jargon-heavy concepts for the everyday Indian.

These influencers use social media platforms to connect with diverse audiences, especially younger generations and underserved communities. Whether it’s via short Instagram reels, long-form YouTube explainers, or Twitter threads, they’ve made finance content engaging, entertaining, and most importantly practical.

Key areas of impact:

- Simplified Financial Education: Influencers break down complex topics such as mutual funds, taxes, stock markets, credit scores, and budgeting into easily digestible content.

- Wide Reach Across Demographics: With millions of followers across platforms, they reach students, working professionals, homemakers, and even rural populations who previously had limited access to financial knowledge.

- Promotion of Digital Tools: Many promote the use of digital wallets, investment apps, and UPI-based systems, boosting digital financial inclusion.

- Fighting Misinformation: By sharing unbiased, data-backed insights, they counter misleading schemes, debunk financial myths, and advocate for responsible money management.

- Motivation to Take Action: Their relatable stories and practical tips inspire individuals to open savings accounts, invest, plan for retirement, and take control of their finances.

If you’re inspired by how these influencers are driving change, why not start your own journey? Use Exly’s all-in-one platform to launch courses, host webinars, and manage your community, no coding or juggling 10+ tools required.

Also Read: Influencer/Astronaut? The Next Gen Choose It A Bit Different

The Role of Social Media in Amplifying Financial Education

Social media has emerged as one of the most powerful tools for spreading financial awareness in India. The country had 491 million social media user identities in January 2025, accounting for 33.7% of the total population.

With platforms like YouTube, Instagram, LinkedIn, and X, financial education is no longer restricted to classrooms or exclusive investment circles. It’s now a part of everyday scrolls, bite-sized, visual, and accessible to anyone with a smartphone.

These platforms allow finance influencers to meet people where they are online. With short videos, infographics, threads, and live sessions, creators can deliver insights on everything from budgeting basics to stock market strategies in formats that resonate with different age groups and learning styles.

How Social Media Is Making a Difference:

- Democratization of Knowledge: Anyone with internet access can now learn about money management, investing, loans, or taxation without paying for expensive courses or advisors.

- Instant Engagement and Feedback: Comment sections, DMs, and polls allow for two-way conversations, where audiences can ask questions, clarify doubts, or request specific content.

- Localized and Vernacular Content: Many influencers create content in regional languages, helping bridge the gap for non-English-speaking audiences and ensuring financial literacy reaches every corner of the country.

- Viral Reach with Everyday Relevance: Financial topics once considered dull are now trending reels and viral tweets, thanks to relatable storytelling, humor, and real-life examples.

- Collaborations and Brand Awareness: Influencers often partner with fintech companies and government campaigns to spread awareness about digital banking, UPI safety, insurance, and more.

Conclusion

In a country as diverse and dynamic as India, finance influencers are playing a crucial role in reshaping how people perceive and manage money. Through social media, they’ve made financial education more relatable, accessible, and actionable for millions.

From simplifying complex concepts to promoting financial inclusion, their impact is both wide-reaching and deeply personal. As more Indians turn to digital platforms for guidance, these influencers are not just content creators, they are educators, mentors, and catalysts for change.

Ready to take control of your financial future?

Explore Exly, the all-in-one platform for creating and sharing high-quality educational content. Whether you’re a financial influencer or someone looking to learn from the experts, Exly provides you with the tools to elevate your financial literacy journey.

Start your free trial today and make finance simple and accessible! Click here to get started!